Did you know that withdrawing money abroad can cost you a lot of money: sometimes for 100 Euros you can pay 10 Euros fees. The same can happens while paying in a shop with your credit card. It probably also already happened to you. You just didn’t notice. We tell you some tricks how avoid this and how to pay the best.

Yesterday I met a German guy on the petrol station in Poznan (Poland) who asked my: »Where is the closest place to exchange money?« – »Why you don’t you use your credit card and the ATM?«, I asked him. – »Because the exchange rate on the cash machine is so bad«, he answered. That was the moment when I understood I really have to write this blog post. He was simply tricked by the cash machine and also while paying for his petrol again.

Some years ago, when I started to travel to Poland more often I had the same reflex: I better change my money on the train station at the currency exchange office (“Kantor” in Polish). The lady there offered an exchange rate of: 1 Euro = 4,25 Polish Zloty (PLN). At the same time the cash machine next to her office offered me an exchange rate of 1 Euro = 3.85 Polish Zloty.

That’s a difference of nearly 10 percent. »Crazy!«, I thought. So I started to research, how this can happen.

If you don’t feel like understanding everything, there is summary at the end of this post.

How the exchange office earns money?

If you ask Google for an exchange rate you will get the mid market rates (which is a value between the selling the buying prices on the global currency market). This gives you a slight feeling of what you might expect, when exchanging money abroad.

A local exchange office usually has an service fee (e.g. 5%). To find out the best options I called today some exchange office and banks and Berlin and asked: »How many Euros do you give me for 10.000 Polish Zlotys (PLN)?«

In Berlin downtown Euro Change offices you get 2,173 Euros (1 € = 4,60 PLN). At TraxelEx at the Berlin Tegel Airport the rate was – like usually on airports – worse: 2,033 Euros (1 € = 4,92 PLN). But if you change your money in Warsaw (for example at Kantor Apollo) you would get 2,347 Euros. Finally I still called the hotline of my bank (HVB UniCredit). The lady told my: »Why do you ask me an not Google?« – »Google told me to expect 2,354 Euro. But I guess that’s not what you will give me.« After 10 Minutes she found out, that it’s not so easy and I actually just get 2,145 Euro (1€ = 4,66) – which is 209 Euros (or 9 percent less than Google told me). What did I learn?

If you have cash and want to use an exchange office you should:

- compare exchange rates between you country and your abroad destination before you start. At the Berlin Airport you loose 13 percent compared to the Warsaw office. That’s a difference of 314 Euros!

- Don’t change everything at the airports. In most of the cases you find better rates in downtown offices.

- Check Google before to get an approximate feeling for the exchange rate you can expect.

But usually I prefer not to have too much cash in my pockets. So how about debit/credit cards and ATMs?

How to avoid bad exchange rates at the ATMs and in shops?

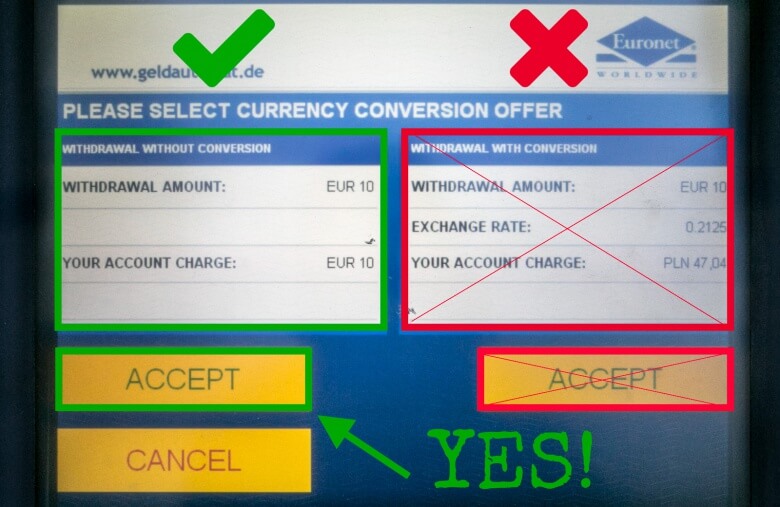

Let’s come back to the guy on the petrol station. If you travel to a foreign country with another currency the cash machine will to ask if you want to withdrawal with currency conversion or without currency conversion. Here you should always use the without conversion option.

Without conversion means, that your local bank will exchange the money. This will give you a good exchange rate. If you choose instead the with conversion option (= dynamic currency conversion), you will get a guaranteed exchange rate, but the ATM/bank can add an up to 10 percent service fee. This is where you loose money. But you can avoid this by using the without conversion option.

I noticed that EuroNet ATMs are usually really expensive. If you use the without conversion some ATMs even show sometimes Warning – Do you really want to do that? In my opinion this is a fraud and it should be forbidden! However – you know what to do!

How to avoid credit card service fees at the ATM?

– With Credit Cards –

There are several way to withdrawal money in other countries without any fee. Some banks offer credit cards that allow you to get money for free.

There are several way to withdrawal money in other countries without any fee. Some banks offer credit cards that allow you to get money for free.

The best you can do in Germany is getting a Visa Card of the DKB bank. Since many years I have such a card I never pay any fees. If you are from Germany, you should definitely use the free DKB Bank Visa Card. To get the card takes some days, so better do it now.

There are also other bank that offer such a credit card, but they either cost a lot of money every year (e.g at Deutsche Bank) or they are hard to get (e.g. Santander Bank). So in Germany the DKB Visa Card is the best option.

If you do not have such a card you pay with a credit card usually 1,75% fee.

– With Maestro-/ EC-Cards / v Pay –

At home you usually can withdrawal money for free with a EC-Card/Meastro when you go to an ATM of you bank or some partner bank. This does not necessarily work in other countries, but it is worth to check carefully the website of your bank.

At home you usually can withdrawal money for free with a EC-Card/Meastro when you go to an ATM of you bank or some partner bank. This does not necessarily work in other countries, but it is worth to check carefully the website of your bank.

With my Maestro Card of the German HVB Unicredit and get money at all Unicredit banks/partner banks in all over Europe. Check the website of your bank to check where you can get money without any charge. Deutsche Bank also has partner banks in many Countries. So before you go on a trip, check the website of your bank!

If your bank does not have a partner bank you will pay between 3 and 10 Euros. That’s a lot.

How to pay the in a shop without fees?

Within the Euro zone you usually also do not pay fees with the Maestro / EC Card / vPay when you pay in a shop or restaurant.

But if you pay in a country with another currency (like Germans in Poland, Czech Republic or Switzerland – or the other way round) you will have a fee of 1% (at least at Unicredit). So every payment in the shop coasts me between 1.50 Euro (min) and 5.50 Euros (max). With a credit card (Visa, Master Card) I would pay 1.75 percent of the price. So cash is the only option without fees in non Euro countries.

But also in the shop they play the excange rate fraud: When paying at this Polish petrol, the lady also asked me: »Do you want to pay in Euro or Polish Zloty«? Thats’s the same thing like on the cash machine – “With conversion or without?”. Here the right answer is »In Zloty«. Always use the local currency! The payment terminal companies to do the same trick as the cash machine – if you convert from your home currency they add the same service charge (at the petrol station the difference 9 percent).

Summary – what is the best way to pay?

So – what is the best way to get money and to pay in a foreign country?

- If you are from and you pay within the Eurozone:

- No ATM fee: Check the website of your bank about and find ou in which foreign (partner) bank you can withdrawl for free with you EC / Maestro / vPay card

- No shop fee: Just pay in the shop with you EC / Maestro / vPay card and you will have no fees (But: this does not apply for Credit Cards like Master Card or Visa Card)

- If the country you visit has a different currency than your home country …..

- No ATM fee: Check the website of your bank about and find out in which foreign (partner) bank you can withdrawl for free with you EC / Maestro / vPay card

- No ATM fee: Check if there’s a bank which offers a credit card for travelling without fees on ATMs. In Germany you can for example start a free account at DKB bank and withdrawl worldwide for free

- No exchange fee: If you withdrawal, always us the option: no currency conversion.

- No shop free: Only if you pay with cash you will not have any fees in the shop. Get your money at the ATM.

- Good exchange rates: If you have to exchange money, check first online to get an idea about average course. Don’t change all you money at the airports – the have usually worse rates. Check if it’s better to change at home or in the country of your destination.

All those little details I learned and checked on my own, during our little and big family travels. Right now I don’t even want to think how much money we have lost in those games;), but since I know now more about it – I wanted to share it with all of you. If you have also some tips – just give us a comment!

If you think this information is worth sharing – ↓ there are the buttons for it ;) Thanks.

This post is also available in: German

Our first book is out!

We have published our first book (for now just in Polish:) about our Central America Trip.

See, read and order here »

6 Comments

It is sad that you sell your Blog and good advises to the DKB Bank. I trusted you now I see that you sold yourself to DKB

good information! I always try to do the deal without the currency conversion, but in the rush of paying you are sometimes forced to press the “no or stop” button to do the deal without currency conversion, which can be difficult. I mean, who likes to press “no or stop” button?

My own bank also throws some rules in the mix, I can use an ATM with my Maestro debet card to get foreign money without an added fee, but using an ATM with my MasterCard creditcard will add a fee. Paying in shops or restaurants its the other way around.

Banks have a lot of ways to make money :)

good website!

sincerely,

Jos

And if you are foreigner living in Germany most probably DKB will refuse you to open account with them.(Happened to me. Tried twice and I have decent income living here for almost 5 years) There is also Comdirect having no fees credit card.

@Kuba: Thank you for this information.

Fee for taking money from ATM is one part – you described how to avoid it – fine :)

Still this post is missing one important part. You wrote: “Without conversion means, that your local bank will exchange the money”.. it’s not all.

The most important part is how your bank exchange the money. So called “spread” ( difference between exchange rates) is what they do to earn money when exchanging it. You can imagine it as transferring let’s say 50 euros to PLN and back to EUR. You definitely won’t get back 50 euros ;)

The more exchanging on the way the more you loose.

For you in Germany it’s a bit different because your bank account is in Euro so in every other Euro country there won’t be exchange. For Polish people it’s good to have card issued in Euros instead of PLN if they travel frequently to countries with Euro currency.

Then you transfer money to your Euro account by yourself which is usually better than exchange rate when you take Euros from bank account in PLN. I use cards from kantor.aliorbank.pl but i’s just an example. I use it becuase I can buy EUR, USD and so on on good rates. I buy a bit of Euros when exchange rate is good and have it there for future travels…and don’t have to worry about exchange rate later.

What is more important – if Polish person goes let’s say to Georgia or even Croatia and take money from ATM there using let’s say Mastercard you transaction will be converted first from local currency to USD and then from USD to PLN. It will be exchanged twice!!!

Every time there is “spread” between it so you loose a bit on both conversions.

It really matters how it’s done and what the “spread” is. It can vary a lot between banks – really a lot ;)

I found that the best way is to have card in USD when you travel outside Euro countries. Then Mastercard only exchange it once from local currency to USD whn you have USD account.

Mastercard exchange rate is quite good…much better than the other part when bank is exchanging later from USD to PLN. That’s the part to avoid ;)

Btw, “So cash is the only option without fees in non Euro countries.” – depends on a card. My from Alior Kantor doesn’t have fee for paying in shops abroad. The same with my normal card form Alior Bank in PLN, but I usually don’t use it abroad because I prefer to use EUR or USD card.

I can’t find good article in English about it but you can read about it in Polish here for example -> http://jakdorobic.com/jak-placic-na-zagranicznych-wakacjach-czyli-o-uzywaniu-kart-platniczych-za-granica-oraz-wyborze-konta-walutowego-dostosowanego-do-waszych-potrzeb/

It explained probably better than I could ;) Or you can just search for “podwójne przewalutowanie” :)

Still I like your article :) There is only missing part about how to avoid this double exchange rates ;)

Wow @Ania – thank you for this comment. I have to check if this also applies to German banks.